Why Nepal Should Buy Bitcoin

October, 2025Summary

Nepal stands at a critical economic crossroads. While maintaining a blanket ban on cryptocurrency, the nation inadvertently isolates itself from a $2.8 trillion digital asset market that continues growing rapidly and engaging over 580 million users worldwide. This essay argues that Nepal should reverse its cryptocurrency ban and strategically accumulate Bitcoin as a sovereign reserve asset, following the successful Bhutanese model while leveraging Nepal’s superior hydropower resources and economic scale.

The strategic case rests on five pillars: protection against fiat currency debasement and global inflation, monetization of surplus hydropower into digital assets, reduction of remittance costs for millions of Nepali families, attraction of foreign direct investment in green technology, and establishment of genuine financial sovereignty independent of larger neighboring economies.

Understanding Bitcoin

Before examining Nepal’s opportunity, understanding what Bitcoin actually is and why it matters becomes essential.

What is Bitcoin?

Bitcoin is digital money that works without banks or governments controlling it. Launched in 2009, it represents the first successful implementation of money that anyone, anywhere can use without needing permission from financial institutions or governments.

Think of Bitcoin as digital gold with some crucial differences. Like gold, Bitcoin is scarce with only 21 million bitcoins that will ever exist, a limit written into its code that nobody can change. Unlike gold, Bitcoin can be sent anywhere in the world in minutes, divided into 100 million tiny pieces called satoshis, and stored without needing physical vaults. Every transaction is recorded on a public ledger called a blockchain, with no central authority controlling the network.

Key characteristics that matter for national reserves include decentralization where no single government or institution controls Bitcoin, permissionless access allowing any nation to hold Bitcoin regardless of its political alignment, transparent recording of every transaction making Bitcoin more traceable than cash, scarcity with a fixed supply that no central bank can expand, liquidity through 24/7 global market trading with over $180 billion in daily volume, and portability allowing billions of dollars to move across borders instantly.

Bitcoin’s Evolution into a Global Asset

In 2009, Bitcoin was worth essentially nothing, with early adopters trading thousands of bitcoins for pizza. By 2013, it reached $1,000, shocking traditional finance before experiencing significant crashes that led critics to declare it dead. Despite this volatility, Bitcoin has appreciated from $430 in 2015 to $107,000 in 2025, a 24,800% increase over 10 years, never failing to recover to new highs given sufficient time.

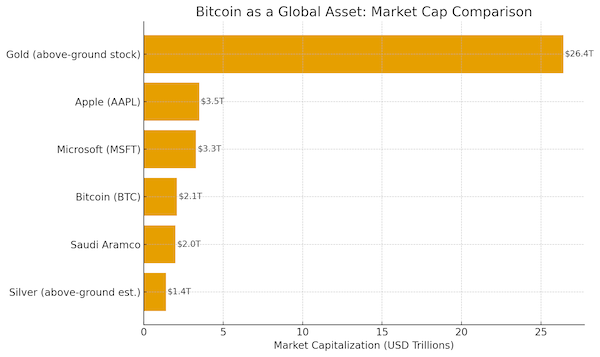

Bitcoin’s market capitalization has grown to over $2.1 trillion, surpassing most national economies

Bitcoin’s market capitalization has grown to over $2.1 trillion, surpassing most national economies

More importantly, the nature of Bitcoin holders has transformed dramatically. Today Bitcoin is held by major institutions like BlackRock and Fidelity managing estimated hundreds of billions in Bitcoin assets, public companies including MicroStrategy with Bitcoin on their balance sheets, nation states like El Salvador and Bhutan holding Bitcoin as sovereign reserves, and 580 million individuals representing nearly 7% of the world’s population.

The cryptocurrency market represents a significant and rapidly growing sector of the global economy.

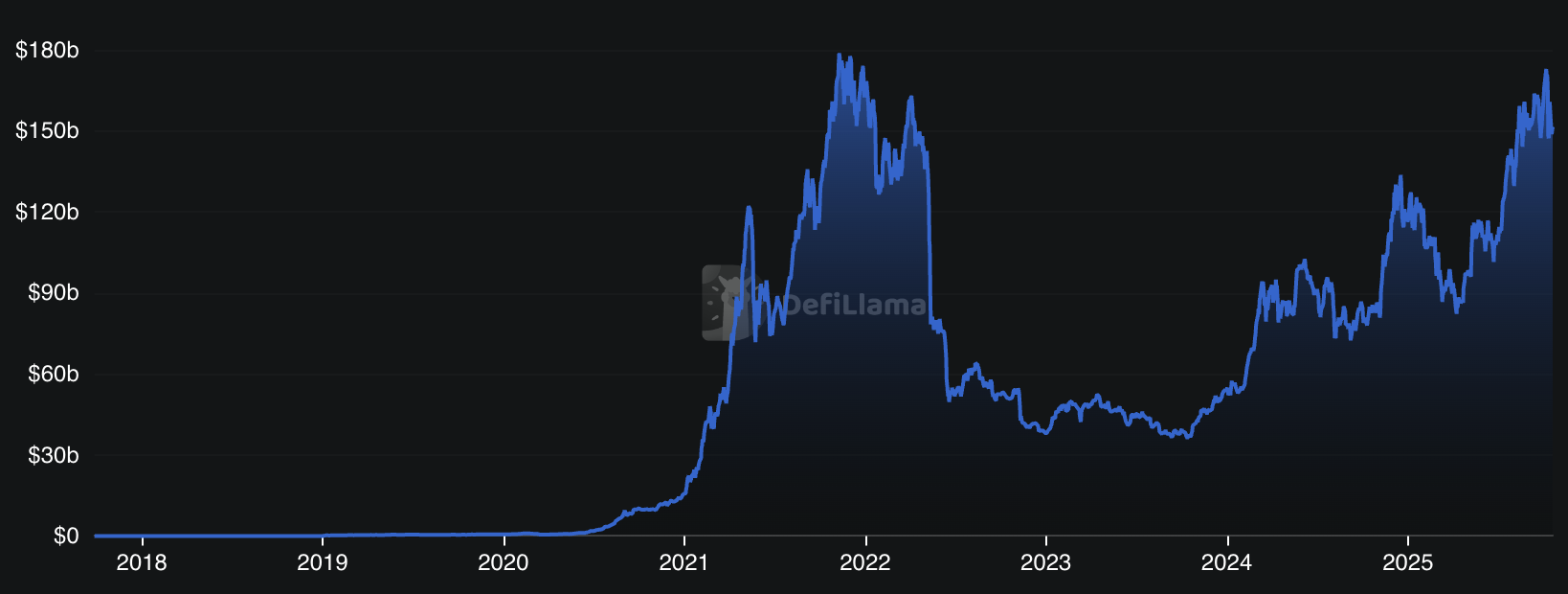

Total value locked in cryptocurrency protocols demonstrates the maturation of the digital asset ecosystem

Total value locked in cryptocurrency protocols demonstrates the maturation of the digital asset ecosystem

Bitcoin’s market capitalization compared to other major global asset classes

Bitcoin’s market capitalization compared to other major global asset classes

The Case for National Bitcoin Reserves

Nations acquire gold for their reserves because it holds value when paper currencies lose purchasing power to inflation, cannot be printed by central banks, and has served as money for thousands of years. During economic crises, gold typically rises in value while currencies weaken.

Bitcoin offers similar properties with modern advantages. Like gold, Bitcoin has a fixed supply and is not controlled by any government, but unlike gold, Bitcoin is easier to store, cheaper to transport, and trades 24/7 on global markets. For a small nation like Nepal caught between larger powers, Bitcoin offers something valuable: genuine financial independence.

When the United States froze $300 billion in Russian reserves in 2022, it reminded every nation that reserves held in dollars remain subject to foreign government decisions. When the Federal Reserve printed 40% more dollars from 2020 to 2022, every nation holding dollar reserves watched their purchasing power evaporate. Bitcoin cannot be frozen by foreign governments and cannot be inflated by central banks, making it attractive for nations seeking genuine reserve diversification.

The Impact of Nepal’s Cryptocurrency Ban

Nepal’s blanket ban on cryptocurrency carries substantial costs that compound annually.

Missed Economic Opportunities

The nation has zero participation in the global digital asset market and zero exposure to digital currencies reshaping international finance. While the blockchain sector attracts tens of billions in venture capital annually and creates thousands of high-paying jobs globally, Nepal captures none of this investment. Zero foreign direct investment flows into Nepal’s blockchain sector, no cryptocurrency exchanges operate legally, no Bitcoin mining facilities convert surplus electricity into digital assets, and blockchain developers face regulatory uncertainty that discourages both local and international companies from establishing operations.

The brain drain accelerates as talented developers see that neighboring countries welcome blockchain innovation while Nepal maintains complete ban, prompting them to leave. The ban doesn’t protect Nepal but drives away the high-skilled, high-earning talent the country needs to build a modern economy.

The Broader Context

Nepal’s ban excludes the nation from an economy that already processes $180 billion in daily trading volume, serves 580 million users globally, and represents a significant portion of the rapidly growing digital economy. The comparison to historical technological shifts is instructive: maintaining complete ban of an established, globally adopted technology rarely protects national interests and more often results in isolation from economic evolution.

Nepal’s Economic Vulnerabilities

To understand why Bitcoin represents more than speculative investment, examining Nepal’s economic structure and inherent vulnerabilities becomes necessary.

Extreme Remittance Dependency

Nepal’s economy runs on money sent home by workers abroad, creating an extraordinary vulnerability.

Nepal’s Key Economic Indicators (2024-2025):

| Indicator | Value | What This Means |

|---|---|---|

| GDP (2024) | $43 billion | Small economy highly vulnerable to external shocks |

| Foreign Exchange Reserves | $18.40 billion (mid-May 2025) | Can cover 14.3 months of imports |

| Remittances (FY 2024/25) | Rs. 1,723 billion (28 to 33% of GDP) | Extreme dependency on foreign labor markets |

| Reserve Composition | 78% convertible currencies, 22% INR | Heavy exposure to USD/INR monetary policies |

| Gold Reserves | 7.99 tonnes (~$1.03 billion) | Minimal precious metal hedge (4% of reserves) |

| GDP Growth Forecast | 4.9% (FY2025) | Moderate but structurally constrained |

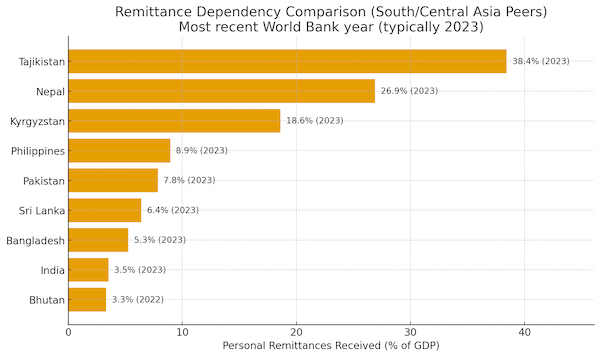

Nepal’s remittance dependency of 26.9% ranks second highest among South/Central Asian peers, exceeded only by Tajikistan

Nepal’s remittance dependency of 26.9% ranks second highest among South/Central Asian peers, exceeded only by Tajikistan

Over half of all Nepali households receive remittances, with more than 2 million Nepali workers currently employed abroad. This means Nepal’s economic stability is fundamentally determined by job markets in Gulf states, Malaysia, and India that could change rapidly, immigration policies in destination countries Nepal cannot influence, and economic conditions in foreign economies over which Nepal has zero control.

A recession in the Gulf states could severely impact Nepal’s economy. Policy changes restricting foreign workers in Malaysia could create significant challenges. Immigration crackdowns in any major destination country could trigger economic stress. This dependency, representing one of the highest remittance-to-GDP ratios globally, constitutes an extraordinary risk that Nepal must address through economic diversification, domestic job creation, and reduced reliance on labor exports.

The Fiat Currency Trap

Nepal’s second major vulnerability stems from limited control over its own currency’s value. The Nepali Rupee is pegged to the Indian Rupee, which means Nepal’s monetary policy effectively mirrors India’s regardless of whether Indian policy serves Nepali interests.

When the Reserve Bank of India adjusts money supply, Nepal experiences the effects automatically. When the US Federal Reserve expands the dollar supply substantially, as occurred from 2020 to 2022, Nepal’s dollar reserves lose purchasing power without any available countermeasures from the Nepal Rastra Bank.

Nepal holds $18.40 billion in foreign exchange reserves with approximately 78% in convertible currencies like US dollars and 22% in Indian Rupees. When major central banks pursue expansionary monetary policies, every dollar and rupee in Nepal’s reserves loses real value despite nominal stability.

Meanwhile, gold prices demonstrate global monetary instability clearly. In mid-July 2024, gold traded at $2,421 per ounce (Rs. 128,000 per tola), but by mid-July 2025 reached $3,324 (Rs. 175,800 per tola) representing a 37% increase in one year. By October 2025, gold broke through $4,000 per ounce (Rs. 211,500 per tola). Central banks globally are racing to accumulate gold, with 95% planning to expand gold reserves according to the World Gold Council, recognizing the need to protect reserves with hard assets that cannot be inflated through monetary policy decisions.

Gold prices breaking through $4,000 per ounce reflect global concerns about fiat currency stability

Gold prices breaking through $4,000 per ounce reflect global concerns about fiat currency stability

Global Gold Reserves Comparison (2025):

| Country | Gold Reserves (tonnes) | % of Total Reserves | Approximate Value | Per Capita GDP |

|---|---|---|---|---|

| United States | 8,133 | 68% | ~$1.05 trillion | $76,000 |

| Germany | 3,352 | 70% | ~$432 billion | $52,000 |

| Italy | 2,452 | 65% | ~$316 billion | $38,000 |

| France | 2,437 | 65% | ~$314 billion | $45,000 |

| Russia | 2,332 | 25% | ~$300 billion | $14,000 |

| China | 2,337 | 4% | ~$296 billion | $13,000 |

| India | 822 | 9% | ~$106 billion | $2,600 |

| Nepal | 7.99 | 4% | ~$1.03 billion | $1,400 |

Nepal holds just 7.99 tonnes of gold worth approximately $1 billion, representing only 4% of total reserves. As a small nation, Nepal faces particular challenges in reserve management, with limited gold holdings providing insufficient hedge against currency volatility compared to the scale of reserves held by larger economies.

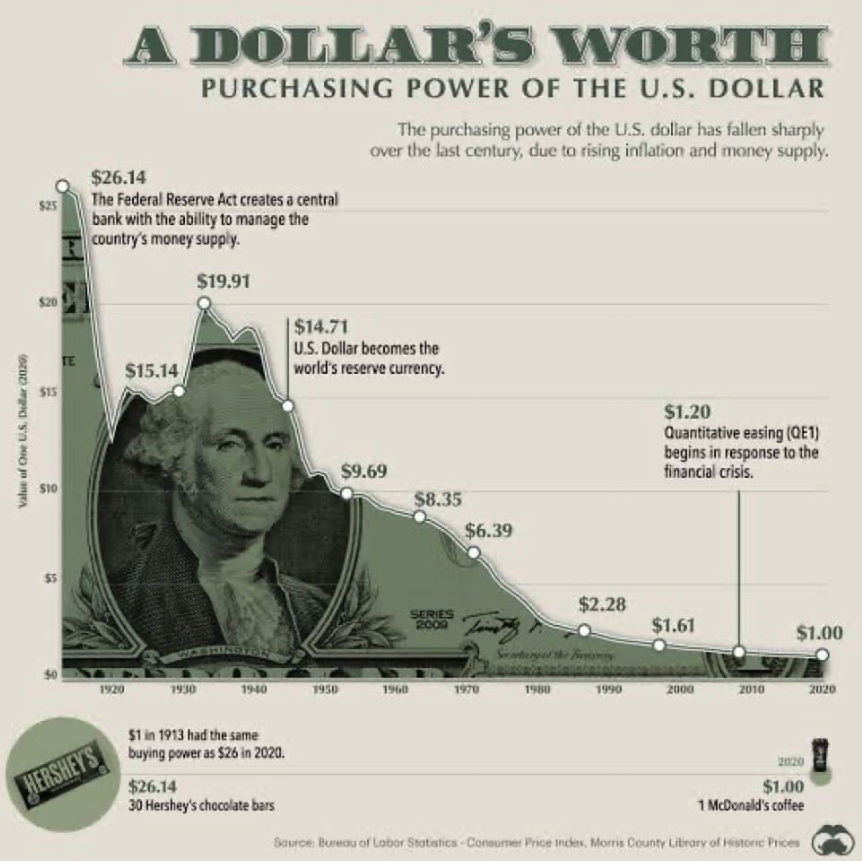

This raises the fundamental question of how Nepal protects its wealth when it has no control over the currencies it holds. Nepal cannot prevent the Federal Reserve from printing dollars, cannot prevent the Reserve Bank of India from changing monetary policy, and cannot prevent global inflation from eroding reserve purchasing power.

Bitcoin becomes relevant here as a reserve asset not controlled by any central bank, with supply fixed at 21 million coins, that cannot be inflated through foreign monetary policy decisions. Bitcoin offers Nepal a reserve asset that can be held independent of other nations’ policy choices.

Reserve Custody Risk

Reserves held in foreign jurisdictions remain subject to political decisions by those governments. In 2022, Western nations froze approximately $300 billion in Russian central bank reserves that Russia had saved and held in dollars and euros in foreign banks. In 2021, the United States froze $7 billion in Afghan central bank reserves held at the New York Federal Reserve.

Nepal maintains excellent international relations and faces no sanctions risk currently, but these examples illustrate a structural reality where reserves held abroad depend on host country decisions. They represent another nation’s liability, another nation’s promise to honor, and in crisis situations, such promises can be revoked.

Bitcoin cannot be frozen by foreign governments. Bitcoin held in properly secured wallets is genuinely owned and controlled by whoever holds the cryptographic keys. For a small nation navigating a complex geopolitical environment between larger powers, this represents a form of genuine sovereignty.

The Bhutanese Case Study

Bhutan provides a directly comparable case study demonstrating that a small Himalayan nation can successfully leverage hydropower resources for Bitcoin accumulation.

Bhutan’s Approach

Between 2017 and 2019, Bhutan’s state-owned Druk Holding and Investments began mining Bitcoin using surplus hydropower, entering when Bitcoin traded between $4,000 and $10,000 per coin. By 2024, Bhutan held between 11,000 and 13,000 Bitcoin worth approximately $1.2 to $1.4 billion at current prices around $107,000 per Bitcoin. For a nation with GDP of approximately $3.3 billion, this represents 35 to 40% of total GDP in Bitcoin reserves alone.

Bhutan Bitcoin Program Overview:

| Metric | Value | Impact |

|---|---|---|

| Program Start | 2017 to 2019 | Entry at $4,000 to $10,000 per BTC |

| Current Holdings | 11,000 to 13,000 BTC | Worth approximately $1.2 to $1.4 billion |

| Percentage of GDP | 35 to 40% | Among largest proportional national holdings |

| Mining Method | 100% hydropower | Completely renewable energy |

| Daily Production | 3 to 5 BTC | $317,400 to $529,000 daily revenue |

| Appreciation | 900%+ since 2020 | Substantial financial gains |

Bhutan has actively managed these reserves by selling portions during price peaks to fund national priorities. In November 2024, they sold $33.5 million worth (367 BTC), and earlier sold another $66 million, realizing approximately $100 million in profits that went directly into government coffers funding initiatives including civil servant salary increases.

Bhutan treated Bitcoin as a working reserve asset rather than a permanent holding never to be touched, demonstrating that Bitcoin can function as practical treasury management for small nations.

Nepal’s Comparative Advantages

Nepal possesses several systematic advantages for pursuing similar strategy.

Nepal vs Bhutan Comparison:

| Factor | Bhutan | Nepal | Nepal’s Position |

|---|---|---|---|

| GDP | ~$3.3 billion | $43 billion | 13x larger economy |

| Population | 0.8 million | 30 million | Significantly larger market |

| Total Hydropower Potential | ~30,000 MW | 83,000 MW | 2.8x greater resource |

| Economically Viable Hydro | ~23,000 MW | 44,000 MW | 1.9x greater potential |

| Current Installed Capacity | ~3,000 MW | 3,256 MW | Comparable starting point |

| Remittance Inflows | Minimal | $11+ billion (28 to 33% GDP) | Substantial opportunity for crypto corridors |

| IT Export Sector | Limited | $515 million+ | Established tech workforce |

| Foreign Reserves | ~$1.5 billion | $18.40 billion | 12x larger reserve base |

Nepal’s economy is substantially larger, providing greater fiscal capacity for measured experimentation. Hydropower potential significantly exceeds Bhutan’s, remittance flows create opportunities for cryptocurrency corridors, and the established IT sector demonstrates existing technical capacity.

Nepal can structure Bitcoin mining through public-private partnerships where international companies provide equipment and capital while Nepal provides surplus hydropower and regulatory clarity. Nepal has successfully used this PPP model for major infrastructure before, with projects like Chilime and Khimti demonstrating how to structure partnerships where private entities provide capital while the state maintains control and ensures public benefit.

Nepal’s Hydropower Opportunity

Nepal sits on substantial untapped renewable energy resources.

The Scale of Untapped Potential

Nepal’s Hydropower Capacity:

| Category | Capacity (MW) | Status |

|---|---|---|

| Total Theoretical Potential | 83,000 | Full resource endowment |

| Economically Viable Potential | 44,000 | What could be developed profitably |

| Current Installed Capacity | 3,256 | Currently built (7.4% of viable potential) |

| 2035 Development Target | 28,500 | National energy strategy goal |

| Untapped Gap | 40,744 | Available opportunity |

Nepal has 44,000 MW of economically viable hydropower potential but has installed just 3,256 MW, meaning over 90% of viable capacity remains undeveloped. During monsoon season from June through September, Nepal produces more electricity than can be consumed domestically or exported to neighbors, with this surplus power often going to waste or selling at minimal prices.

Rivers flow down from the Himalayas generating potential energy continuously, and during monsoon, this energy exceeds what Nepal’s economy can currently absorb. While Nepal has signed an agreement to export 10,000 MW to India over the next decade, building that export capacity requires years of infrastructure development, leaving substantial energy unused in the interim.

Bitcoin mining offers a practical solution to this challenge. Unlike factories or traditional industries requiring stable year-round power, Bitcoin mining operations can operate as interruptible load by shutting down when domestic demand rises, scale up during monsoon when surplus is maximum, scale down during dry season when power is constrained, convert electricity directly into digital assets without requiring immediate buyers, and generate hard currency earnings independent of bilateral trade negotiations.

Revenue Potential

Examining what Bitcoin mining could generate for Nepal using current market conditions and conservative assumptions reveals substantial potential.

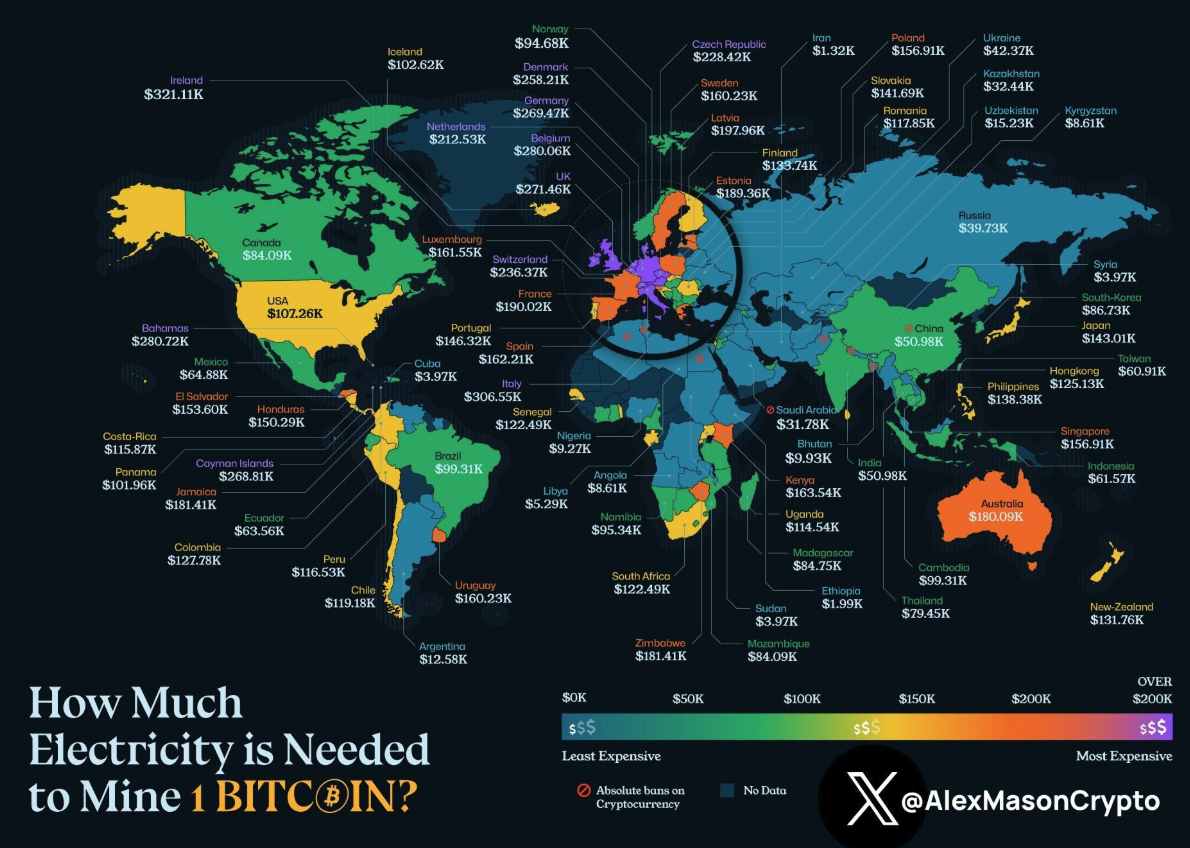

Bitcoin mining costs vary by electricity price, positioning Nepal’s low-cost hydropower as a competitive advantage

Bitcoin mining costs vary by electricity price, positioning Nepal’s low-cost hydropower as a competitive advantage

Bitcoin Mining Revenue Scenarios:

| Scale | Annual Revenue (Conservative) | Comparison |

|---|---|---|

| 30 MW | $12.8 to $25.6 million | 2 to 4.5x Everest permit revenue |

| 60 MW | $25.6 to $51.2 million | 4 to 9x Everest permits |

| 150 MW | $65.7 to $127.8 million | 11 to 23x Everest permits |

A modest 30 MW pilot operation could generate $12.8 to $25.6 million annually, representing multiple times what Nepal earns from Everest climbing permits. Scaling to 150 MW, still a small fraction of surplus capacity, could generate $65.7 to $127.8 million yearly.

Comparative Revenue Analysis:

| Revenue Source | Annual Value | Notes |

|---|---|---|

| Everest/Mountaineering Royalties | $5.7 to 5.9 million | Nepal’s iconic global brand |

| Bitcoin Mining (30 MW) | $12.8 to 25.6 million | Using power currently wasted |

| Bitcoin Mining (150 MW) | $65.7 to 127.8 million | Only 0.3% of viable hydro capacity |

| IT Service Exports | $515 million | Could complement crypto infrastructure |

| Tourism (FY 2024/25) | ~$643 million | 6 to 7% of GDP |

These calculations are based on current Bitcoin prices around $107,000, current mining hardware efficiency, and current electricity costs. The mining operations would utilize electricity that currently provides minimal value because Nepal cannot fully consume or export it during peak production periods.

Clean Energy Bitcoin Positioning

Nepal can differentiate itself globally and capture premium value through clean energy certification. The cryptocurrency industry faces environmental criticism where Bitcoin mining has historically relied on fossil fuel electricity, creating concerns that institutional investors consider seriously.

ESG-focused investment funds managing substantial capital globally require proof that Bitcoin is mined using renewable energy. Major corporations and Bitcoin ETFs actively seek certified clean BTC to maintain sustainability commitments.

Nepal can position itself as a premier source of 100% clean, renewable, carbon-free Bitcoin. “Himalayan Clean Bitcoin” backed by monsoon-fed rivers carries meaningful branding in global markets. While many mining operations still rely on fossil fuels or mixed energy grids, Nepal offers guaranteed 100% hydropower.

This certification can command premium pricing, with Nepal’s state-controlled operations providing the transparency and environmental verification that institutional buyers demand. The timing aligns well with growing global demand for sustainable Bitcoin while supply remains limited.

Strategic Reserve Accumulation

Beyond mining, Nepal should consider direct Bitcoin accumulation as part of reserve diversification strategy.

The Rationale for Diversification

The Nepal Rastra Bank manages foreign exchange reserves to provide economic stability and protect against uncertainty. Recently, the daily gold import limit was raised to 25 kg, acknowledging gold’s continuing importance for reserves despite foreign exchange management considerations.

Bitcoin could be considered as an additional component of reserve assets, complementing rather than replacing gold or traditional reserves. Several factors support beginning Bitcoin accumulation:

-

The global financial system shows increasing fragmentation as tensions between dollar and yuan spheres create risks for small nations caught between major powers. Nations increasingly seek monetary options that don’t force alignment with either sphere.

-

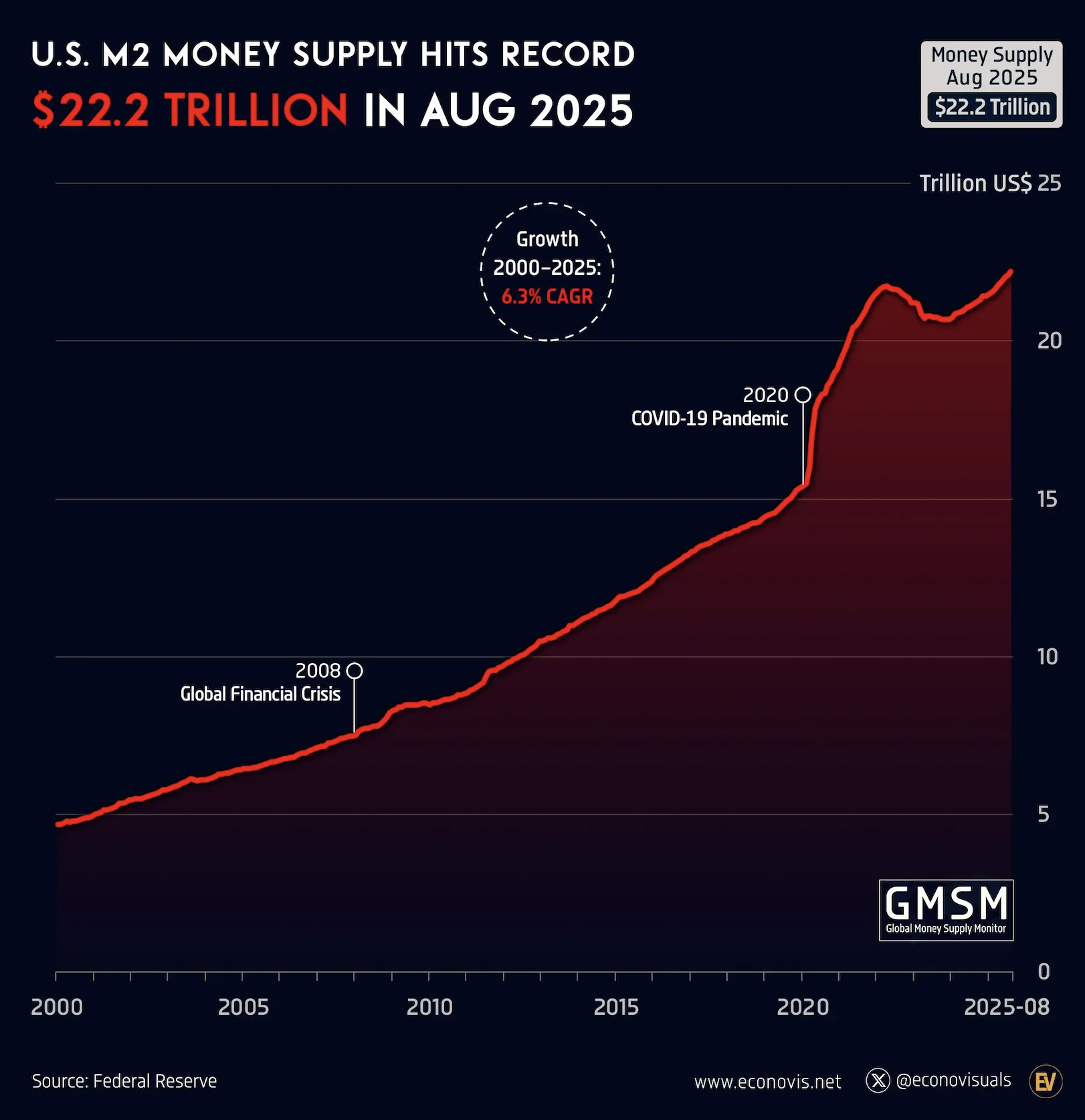

Fiat currency debasement continues as major central banks expand money supply substantially. The US money supply expansion of 40% from 2020 to 2022 represents part of a longer-term pattern. Since 1971, when the dollar left the gold standard, purchasing power has declined significantly, with dollar-holding nations watching their reserves slowly lose real value.

US M2 money supply showing dramatic expansion, particularly during 2020-2022, diluting the value of dollar reserves

US M2 money supply showing dramatic expansion, particularly during 2020-2022, diluting the value of dollar reserves

The US dollar has lost over 95% of its purchasing power since leaving the gold standard in 1971

The US dollar has lost over 95% of its purchasing power since leaving the gold standard in 1971

Institutional acceptance has grown substantially. In 2013, Bitcoin appealed primarily to technology enthusiasts, but in 2025, major endowments, pension funds, and asset managers hold Bitcoin. Reports indicate that institutions now hold significant portions of Bitcoin exchange-traded products, signaling mainstream financial acceptance.

Conservative Implementation Approach

Nepal should start conservatively, perhaps allocating 0.5 to 1% of reserves initially with flexibility to expand based on demonstrated results. The emphasis should be on learning and adapting rather than remaining completely excluded while regional competitors establish positions.

Historical perspective provides useful context. A hypothetical investment of just $10 million in Bitcoin in 2015, representing 0.05% of reserves at that time, would be worth approximately $2.5 billion today. The opportunity cost of prolonged delay accumulates as Bitcoin’s fixed supply faces increasing global demand.

This observation does not predict Bitcoin will reach any specific future price. It simply recognizes that scarce assets generally appreciate as demand increases, and that early positioning carries both higher risk and higher potential reward. Nepal’s approach through state-controlled mining operations and modest direct purchases limits downside risk while maintaining meaningful upside exposure.

Active treasury management, as demonstrated by Bhutan’s periodic sales during price peaks, provides a practical template. Rather than treating Bitcoin as permanent holdings, viewing them as actively managed assets allows monetization when opportune. The goal is complementing traditional reserve assets with modest allocation to a genuinely different asset class offering unique benefits: immunity from sovereign monetary policy decisions, resistance to confiscation or freezing, and potential for appreciation as global adoption expands.

Attracting Digital Economy Investment

Reversing the cryptocurrency ban would enable foreign direct investment in blockchain sector.

Global Investment Flows

In 2024, venture capital in cryptocurrency reached $24.8 billion with 45% year-over-year growth. Mining infrastructure attracted $8.2 billion with 67% growth, and blockchain development captured $15.3 billion growing at 52% annually.

Current regional distribution shows North America capturing 42% of this investment, Europe 28%, and Asia-Pacific 24%. Nepal currently captures zero percent due to the ban. Clear regulatory frameworks and competitive advantages could redirect meaningful portions of Asia-Pacific investment to Nepal.

Nepal’s Competitive Position

Nepal possesses unique advantages for attracting blockchain investment.

Nepal’s Competitive Advantages:

| Advantage | Description | Investment Impact |

|---|---|---|

| Clean Energy Cost | Among lowest cost hydropower in South Asia | Attracts green mining operations |

| Strategic Location | Between major South Asian markets | Regional hub potential |

| Tech Workforce | Significant freelancer base in software development | Development center capability |

| First-Mover Positioning | Clear crypto frameworks could differentiate in region | Regulatory advantage |

Clear regulatory frameworks, competitive hydropower costs, and government support can attract substantial foreign direct investment. Green mining zones utilizing Nepal’s hydropower surplus can attract mining infrastructure investment from international operators seeking low-cost clean energy. Licensing frameworks for cryptocurrency exchanges can bring platform investment. Regulatory sandboxes for blockchain experimentation can attract development and research investment, while educational facilities can partner with international institutions.

Reversing the ban and establishing thoughtful regulation would transform Nepal from completely excluded to potentially competitive for blockchain-related investment flowing to Asia-Pacific. The combination of surplus renewable energy, technical workforce, and strategic location creates value proposition for international blockchain companies seeking operational bases in the region.

Addressing Common Concerns

Volatility Considerations

Bitcoin has crashed multiple times. In 2018, it fell from $20,000 to $3,000. In 2022, it dropped from $69,000 to $16,000. This volatility naturally concerns policymakers thinking about Bitcoin for national reserves.

However, impact depends on allocation size. If Nepal puts just 1 to 2% of reserves in Bitcoin, even a 50% crash means only 0.5 to 1% total loss. That’s normal volatility from currency swings. Reserve holdings are long term strategies with 10 to 20 year horizons, not day trading. Daily or monthly price movements matter less than the long term direction.

Despite crashes, Bitcoin recovered to new highs every time, growing 24,800% from 2015 to 2025. Meanwhile, holding 78% of reserves in dollars has its own risk. When the Federal Reserve prints money, purchasing power gradually erodes. The presentation differs between slow debasement versus dramatic volatility, but wealth reduction occurs either way.

Major universities and companies hold Bitcoin despite volatility. These conservative institutions managing billions with fiduciary responsibilities haven’t found volatility disqualifying when properly sized. The key is conservative allocation representing prudent diversification rather than reckless speculation.

Illegal Activity Concerns

The 2024 Chainalysis report found only 0.34% of cryptocurrency transactions involve crime. The UN estimates 2 to 5% of cash facilitates illegal activity. Cryptocurrency is actually cleaner than cash because every Bitcoin transaction records permanently on a public ledger anyone can check.

Law enforcement traces cryptocurrency easily, catching criminals through blockchain analysis. Many prosecutions succeed specifically because transaction patterns revealed illegal activities.

The internet enables crime, as do phones and banks, yet we regulate these rather than ban them. Illegal applications get prosecuted while legal uses continue. Proper cryptocurrency regulation with KYC and AML rules would reduce illegal activity more than prohibition, which pushes legitimate users underground.

Capital Flight Considerations

This concern misunderstands what actually causes capital flight. Capital already leaves Nepal in significant amounts. Talented workers emigrate to countries offering better opportunities. Businesses struggle to bring foreign investment due to complex regulations. Young graduates leave for jobs abroad because domestic opportunities remain limited.

The cryptocurrency ban doesn’t prevent this. If anything, it makes the problem worse by signaling that Nepal is closed to emerging technologies and innovation. Tech workers see neighboring countries welcoming blockchain development and choose to build their careers there instead.

Clear cryptocurrency regulations would attract capital inward, not push it out. When countries create sensible frameworks, they attract foreign investment in new sectors. Legal crypto businesses would bring foreign capital into Nepal. Proper remittance systems would make money flows more visible and taxable rather than forcing them through informal channels. Mining operations would convert domestic hydropower resources into digital assets without any capital leaving the country.

Nepal already has capital controls in place. These can work alongside Bitcoin regulations, as other countries have demonstrated. The issue isn’t whether to have capital controls but whether cryptocurrency regulation should be part of a broader, thoughtful approach to managing capital flows.

The real capital flight happens when talented people see no future at home. When skilled developers, entrepreneurs, and innovators cannot build legal businesses in emerging technologies, they leave. The ban doesn’t protect Nepal from capital flight. It guarantees it by driving away exactly the people and investments Nepal needs for economic growth.

Timing Questions

Bitcoin crossed major milestones. Market value exceeds $2.1 trillion, surpassing most national economies. Major banks like BlackRock and Fidelity offer Bitcoin products to institutional clients. Several countries hold it as reserves.

Starting early in scarce asset markets provides advantages. Waiting means higher entry prices for the same allocation. Each year of ban represents missed opportunities as competitors build positions and infrastructure.

Other Asian nations created clear frameworks while Nepal maintains total ban. This creates isolation risk as the only regional nation with complete ban while others develop regulatory clarity and attract investment. The cautious approach of waiting sounds prudent but carries real opportunity costs as the digital economy grows with or without Nepal.

Environmental Considerations

Nepal addresses environmental concerns directly. All mining would use 100% renewable hydroelectricity with zero fossil fuels. Nepal has negligible coal, minimal natural gas, and limited oil generation.

More importantly, Nepal’s mining would use currently wasted energy. During monsoon season, hydropower production exceeds what can be consumed domestically or exported. This surplus provides minimal current value now.

Mining with curtailed power monetizes renewable energy that otherwise flows unused through turbines. It doesn’t displace any productive use. Nepal could lead global sustainable Bitcoin mining, showing that properly implemented cryptocurrency mining with surplus renewable energy represents sound economic development. This would attract premium prices from investors who value clean energy certification.

Conclusion

Nepal faces a fundamental choice between maintaining absolute cryptocurrency ban or pursuing measured, strategic engagement through state-controlled mechanisms.

Continuing the current ban means sustained isolation from major sectors of the rapidly growing digital economy. It means missing opportunities to monetize surplus hydropower that currently generates minimal value. It means watching regional competitors establish positions and infrastructure while Nepal remains excluded. It means talented technical workers continuing to emigrate to jurisdictions offering clearer regulatory frameworks.

The alternative involves measured, strategic engagement accepting some volatility risk in exchange for substantial potential benefits. This means initiating Bitcoin mining operations that convert monsoon surplus electricity into digital assets. It means accumulating modest Bitcoin reserves providing genuine diversification against fiat currency debasement and external monetary policy decisions. It means attracting foreign direct investment in blockchain sector while positioning Nepal as a leader in sustainable digital asset production.

The fundamental question is whether Nepal can afford to completely ignore digital asset evolution while facing vulnerabilities from remittance dependency, fiat currency debasement, and monetary policies controlled by foreign powers, when modest, carefully managed strategic exposure might provide meaningful benefits with acceptable and manageable risks.

Bitcoin offers practical solutions through monetizing clean energy, diversifying reserves with assets immune to foreign monetary policy decisions, and building genuine financial independence in an increasingly complex global monetary system.

This represents strategic economic policy appropriate for a nation navigating challenging geopolitical and economic circumstances. The choice will significantly influence Nepal’s economic resilience and monetary sovereignty in coming years.

Further Reading

For readers seeking deeper understanding of Bitcoin economics and monetary theory:

-

“Bitcoin: A Peer-to-Peer Electronic Cash System” by Satoshi Nakamoto (PDF) - The original 2008 whitepaper introducing Bitcoin

-

“The Price of Tomorrow” by Jeff Booth - Why technology causes deflation and fiat currency systems must inevitably debase

-

“Layered Money” by Nik Bhatia - Understanding the evolution of monetary systems and Bitcoin’s role

-

“Bitcoin as a Reserve Asset” - Fidelity Digital Assets (White Paper)

-

“Why India Should Buy Bitcoin” by Balaji Srinivasan

-

“When Bitcoin Wins” by Balaji Srinivasan (Thread)

-

“The Bitcoin Standard” by Saifedean Ammous - Comprehensive examination of Bitcoin as sound money

Data Sources & Verification

All major claims in this essay are based on publicly available data from authoritative sources. Key data points cited:

Nepal Economic Data:

- GDP (2024): $43 billion - Nepal Rastra Bank (nrb.org.np)

- Foreign Exchange Reserves (May 2025): $18.40 billion (covers 14.3 months of imports) - Nepal Rastra Bank monthly reports

- Remittances (FY 2024/25): Rs. 1,723 billion (28-33% of GDP) - Nepal Rastra Bank

- Gold Reserves: 7.99 tonnes (~$1.03 billion, representing 4% of total reserves) - Nepal Rastra Bank 2025

- Reserve Composition: 78% convertible currencies (primarily USD), 22% Indian Rupees - Nepal Rastra Bank

- GDP Growth Forecast (FY2025): 4.9% - World Bank, IMF, Asian Development Bank

- Average Remittance Cost: 3.7% of transaction value - World Bank Remittance Prices Worldwide database

- Nepali Workers Abroad: 2+ million workers currently employed overseas - Various government sources

Cryptocurrency Market Data:

- Bitcoin Market Cap: $2.1+ trillion (October 2025) - CoinMarketCap, CoinGecko

- Bitcoin Price (October 2025): ~$107,000 per BTC - Market data aggregators

- Daily Trading Volume: $180+ billion - CoinMarketCap, CoinGecko

- Global Cryptocurrency Users: 580 million (approximately 7% of world population) - Crypto.com Global Adoption Report

- Total Crypto Market Size: $2.8 trillion - Market data (October 2025)

- Illicit Activity Percentage: 0.34% of total cryptocurrency volume - Chainalysis 2024 Crypto Crime Report

- Bitcoin Appreciation (2015-2025): From $430 to $107,000 (24,800% increase over 10 years) - Historical price data

- Institutional Holdings: Estimated hundreds of billions in Bitcoin ETPs - Various industry reports

Cryptocurrency Investment Flows (2024):

- Total VC Investment: $24.8 billion (45% YoY growth) - Industry reports

- Mining Infrastructure Investment: $8.2 billion (67% growth) - Industry reports

- Blockchain Development Investment: $15.3 billion (52% growth) - Industry reports

- Regional Distribution: North America 42%, Europe 28%, Asia-Pacific 24% - Venture capital data

Bhutan Bitcoin Holdings:

- Estimated Holdings: 11,000-13,000 BTC (~$1.2-1.4 billion at current prices) - Bitcoin Treasuries, Arkham Intelligence (July 2025)

- Percentage of Bhutan GDP: 35-40% (Bhutan GDP ~$3.3 billion) - Calculated from holdings data

- Program Start: 2017-2019, entry at $4,000-10,000 per BTC - Public blockchain records

- Mining Method: 100% hydropower via Druk Holding and Investments - Government statements

- Estimated Daily Production: 3-5 BTC ($317,400-$529,000 daily) - Based on publicly reported capacity

- Known Sales: $33.5 million (367 BTC) in November 2024, plus $66 million earlier (~$100 million total realized gains) - Blockchain transaction records

- Appreciation: 900%+ since 2020 - Calculated from entry and current prices

- Note: Bhutan government has not officially disclosed complete program details; estimates based on blockchain analysis

Gold Market Data:

- Gold Price (July 2024): $2,421/oz - Kitco, World Gold Council

- Gold Price (July 2025): $3,324/oz (37% annual increase) - Market data

- Gold Price (October 2025): $4,000+/oz - Bloomberg, market data

- In Nepali Terms: July 2024: Rs. 128,000/tola, July 2025: Rs. 175,800/tola, October 2025: Rs. 211,500/tola

- Central Bank Survey: 95% of central banks planning to expand gold reserves - World Gold Council October 2025 survey

- Global Gold Holdings: US (8,133 tonnes), Germany (3,352 tonnes), Italy (2,452 tonnes), France (2,437 tonnes), Russia (2,332 tonnes), China (2,337 tonnes), India (822 tonnes) - World Gold Council 2025

Hydropower Data:

- Total Theoretical Potential: 83,000 MW - Nepal Electricity Authority

- Economically Viable Potential: 44,000 MW - NEA reports

- Current Installed Capacity: 3,256 MW (7.4% of viable potential utilized) - NEA 2025

- 2035 Development Target: 28,500 MW - National energy strategy

- India Export Agreement: 10,000 MW over next decade - Public bilateral agreements

- Bhutan Hydropower (Comparison): 30,000 MW total potential, ~23,000 MW viable, ~3,000 MW installed - Various sources

Monetary Policy & Currency Data:

- US M2 Expansion (2020-2022): 40% increase in money supply - Federal Reserve data

- Dollar Purchasing Power Loss (1971-2025): 95%+ decline since leaving gold standard - Historical inflation data

Mining Revenue Projections:

- 30 MW Operation: $12.8-25.6 million annually (conservative estimate)

- 60 MW Operation: $25.6-51.2 million annually

- 150 MW Operation: $65.7-127.8 million annually

- Everest Permit Revenue (Comparison): $5.7-5.9 million annually

- Tourism Revenue (FY 2024/25): ~$643 million (6-7% of GDP)

- IT Service Exports: $515+ million - IIDS 2022 report

- Assumptions: Bitcoin @ $107,000, current network hashrate, current mining hardware efficiency (Antminer S21 class, ~17.5 J/TH), Nepal hydropower cost $0.02-0.04/kWh

Note on Mining Calculations: Revenue projections are estimates based on October 2025 market conditions. Actual results would vary significantly with Bitcoin price changes, network difficulty adjustments, hardware efficiency improvements, and operational costs. A 50% Bitcoin price decline would reduce revenues proportionally.

Disclaimer: This essay was written with AI assistance. All data is sourced from publicly available information as of October 2025, but readers should independently verify key claims. Bitcoin prices and economic projections are inherently uncertain and subject to change.